“The Economic Ideas that Guide the Hands (paraphrase, Young-people)”

MICHAEL STUTCHBURY

Nov 29, 1990 – 11.00am

JOHN Maynard Keynes wrote that the world was ruled by little else than the ideas of economists and political philosophers, be they right or wrong.

“Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually the slaves of some defunct economist,” he suggested in his General Theory more than half a century ago.

[In Australia, the levers of economic power are still pulled by practical men (yes, men).] But these days, their hands are heavily guided by the powerful orthodoxy of contemporary economics and economists.

Many of the divisive political economy debates of the 1970s have been resolved in favour of the so-called rationalists: the ACTU agrees that wage blow-outs are bad for jobs; no-one today dares call for higher tariff protection; and no-one is now calling for Budget pump-priming to avoid recession.

The influence of economic rationalism has been extended further by the broad agenda of “microeconomic reform”, and Australia’s historic change of course during the 1980s to expose its protected industries to the discipline of world producer and finance markets.

It is symbolised by the rise of the econocrats, the economics-trained bureaucrats who have made major territorial gains through the Canberra Public Service in the past decade. Their world view is reinforced by the financial markets, the intellectual dominance of rationalist think-tanks and the opinion-makers in the up-market media, who subscribe to a similar orthodoxy.

[Although business pulls the levers and presses the buttons] which set the production lines going and the cash registers ticking, Canberra’s policy decisions influence the key prices and markets faced by the corporate sector: the price of money, the exchange rate, the degree of import competition, its debt-servicing costs, the buoyancy of the domestic market and so on.

And, in a relatively small economy dominated by oligopolies, Canberra’s regulatory framework literally guides the flow of billions of dollars in industries such as telecommunication, aviation, banking, superannuation, motor vehicles and broadcasting.

The rise of the econocrats affects all these areas and has paralleled the spread of rationalist economic criteria from the power centres of Treasury, Finance, Prime Minister & Cabinet and the offices of the key economic ministers, to departments primarily responsible for public policies ranging from education, training and transport to social welfare, immigration and telecommunications – just about every portfolio except defence.

According to one survey of Canberra’s senior executive service, more than half of the top bureaucrats can boast qualifications in economics, business or accounting.

Even the trade bureaucracy has had its protectionist elements of McEwenism cleaned out.

After the heated disputes of the 1970s, the Tariff Board of Alf Rattigan (an early honorary econocrat) and the Industries Assistance Commission has now intellectually defeated the protectionist policies which have greatly shaped Australia’s economic development.

And even the director of the National Institute for Economic and Industry Research, Peter Brain, has accepted Labor’s tariff cuts after providing the most vigorous academic pro-protection arguments in the 1970s.

And, although the Minister Industry, John Button – an IAC sceptic – was the politician who pulled the levers to dismantle protectionism, the IAC won the intellectual debate by using essentially the same simple theoretical framework devised two centuries ago by Adam Smith: that is, that economies should concentrate on what they do best and not attempt to prop up uncompetitive industries.

Protectionist business leaders of the 1970s such as Repco’s Neil Walford would look antique amid the dominant rationalism of the 1990s.

The Tariff Board’s current manifestation, the Industry Commission, has been given a wider brief – to search out and expose regulatory inefficiencies throughout the economy – and a powerful econocrat to lead it in the form of ex-Keating adviser Tony Cole.

The rationalist econocrat advice going to politicians can be boiled down to more market deregulation, more reliance on competitive price-setting to allocate resources, less government regulation, more user-pays funding for public services, and greater exposure of the economy to the discipline of competition on world markets.

The balance-of-payments and foreign-debt crises have added to the push for micro-economic reform, itself a buzz-word for applying textbook economic principles to market regulation and public policy.

The orthodox response to the balance-of-payments crisis of markedly tightening fiscal policy and reducing the Federal Budget surplus has dovetailed into this by seeking to get better value for public spending – a classic example of the economists’

focus on maximising the use of limited resources.

Yet it is not entirely laissez faire. The Reserve Bank, for instance, has little regard for the intelligence of the financial markets or the infallibility of the banks.

It continues to intervene in the foreign exchange market to “dirty” the float. The Reserve Bank’s head of research, Ian Macfarlane, provided the earliest critique of the 1980s debt boom in terms of an “overshooting” of asset prices, particularly in the equity and property markets.

The Piaget 4 stages of human mental deveopment going to another 4 and notionally 5 – to WHOLE OF healthy well-norished life educational reform and the “revolutionary” removal of idiot Social-universe dialectitians & Marxian praxis nutters from Twenty-five Thousand universities

And Treasury has never suggested that the Australian economy, described by Paul Keating as a “bucking bronco” because of its exposure to commodity price shocks, should be “unguided”.

Under Chris Higgins, the Treasury is still prepared to go along with the deal-making of Labour’s wage Accord.

The ex-Treasury head and current Reserve Bank Governor, Bernie Fraser, has stressed the need to gain political acceptance for policy change and also qualifies as an econocrat “Accordian”.

The econocrats remain “can do” policy advisers – and in Fraser’s case, a puller of levers. Unlike the hard-line Treasury in the days of John Stone, they are prepared to tailor economic reform to political “realities” while, at the same time, musing over how to maintain the pace of economic reform outside a period of crisis.

The Department of Finance head, Michael Keating, has approvingly described the Hawke Government’s approach as “bargained consenus” or “a unique blend of deregulation, aimed at improving the operation of markets, and a ‘new’corporatism, aimed at more closely embracing business and unions in the policy formation process”.

This, in essence, is the Australian response to the 1970s collapse of Keynesian-influenced aggregate demand management under the twin evils of high inflation and high unemployment.

While maintaining elements of “consensus” reform, it has been heavily influenced by the international emphasis on supply-side efficiency as the key to improved economic performance – a shift climaxed by the Eastern Bloc rejection of central planning.

The vague push by the Employment, Education, and Training Minister John Dawkins for some sort of government assistance for exporters is unlikely to have much support from his econocrat advisers, who are led by the rationalist Greg Taylor, a former IAC chairman.

The Australian embrace of rationalism has not been as zealous as”Rogernomics” in New Zealand, where the Treasury was heavily influenced by the extreme free marketeers of the University of Chicago to spark an unedifying brawl with the economists at Wellington’s Victoria University.

Even in NSW, where economic rationalism has made its greatest inroads at a State Government level under Premier Nick Greiner, to establish a moral high ground over the discredited interventionism of the Cain, Burke and Bjelke-Petersen governments, the reform program is tempered by “dry and warm”political considerations.

In Australia, the main rationalist impetus has not come from the academic economists who, during the 1980s, lost the sort of prominence gained during the Whitlam days.

Yet the university economists are making a quiet comeback to policy influence, most notably through such commissioned government reports as by the Australian National University’s Helen Hughes (which questioned the effectiveness of export assistance) and Ross Garnaut (which praised the virtues of free trade).

Professor Hughes also was a member of the FitzGerald committee which recommended giving a “greater economic focus” to Australia’s immigration programme.

As well, the role of university economists is being revived because they speak much the same language as the ascendant econocrats – at least at the ANU which runs the closest thing in Australia to a US-style graduate school. Increasingly, ANU economists are involved in the Canberra policy chat sessions with econonocrats organised by the Economic Planning Advisory Council secretariat.

And the ANU’s Bob Gregory holds the academic economist spot on the Reserve Bank board.

Whereas Treasury economists in the 1960s were most likely to have been educated at the University of Melbourne, today they and the econocrats elsewhere in the bureaucracy tend to have received their post-graduate training, if not their first degree, from the ANU. The other main econocrat-academic link is between the Industry Commission and the University of Melbourne, where both the ORANI econometric model project and the Institute of Applied Economic and Social Research are based.

The ANU’s economics department is noted for its high technical and mathematical rigour and perhaps best represents what Peter Groenewegen and Bruce McFarlane complain in their new book (A History of Australian Economic Thought) to be the Americanisation of university economics teaching in Australia.

This, they suggest, is based on the methodological assumption of individual choice; with perfectly informed consumers maximising their utility; businesses maximising their profits; where economic agents operate in competitive markets and so are typically price-takers; and where government intervention is tainted by definition.

“Hence deregulation, competition and anti-monopoly policy become essential prescriptions to turn the textbook vision into real life,” bemoan Groenewegen and McFarlane.

“Much of this North American market economics is now fully absorbed into Australian teaching of economics. The older traditions of a positive role for government in ensuring those social goals the market was seen as unable to achieve have been relegated to the background”.

True, the emphasis of American university economists on highly abstruse mathematical techniques to model sometimes dubious assumptions about human behaviour has spread to the younger generation of Australian academics.

But, in the Australian context, “rationalist” economics does not necessarily conflict with a more mainstream or even social democrat perspective.

Parts of the microeconomic agenda, such as waterfront reform and more user-pays road pricing, are unexceptional reforms which have been given impetus by the rationalist programme. Even a left-wing Labor politician such as Brian Howe has been prepared to introduce more “stick” into the social welfare system – a hobby horse of the rugged pro-marketeers.

Level-playing-field arguments support the taxing of non-wage income such as capital gains and fringe benefits – and possibly even wealth and bequests. And as the University of Sydney’s Judith Yates pointed out in work for the Campbell Report more than a decade ago, financial deregulation did not benefit the poor.

Thanks to Paul Keating’s deregulation, the big demand for economists has been in the financial markets.

Most of the leading finance sector economists have been poached from the training grounds of Treasury or the Reserve Bank and lured by the basic economic enticement of money. Top-level examples include Westpac’s David Morgan from Treasury and Bain’s Don Stammer from the Reserve Bank. Examples at the chief economist level include the Macquarie Bank’s Bill Shields from the Reserve Bank and the National Bank’s Julian Pearce and BT’s Andre Morony from Treasury.

These ex-econocrat market economists have an influence on macroeconomic policy mainly as articulators of the financial market’s conventional economic wisdoms.

But, increasingly, they have been relegated to short-term economy watchers required to give the money market dealers split second “buy” or “sell”responses to the latest Bureau of Statistics release. Paul Keating is no longer obsessed with “trumping” market expectations over the Budget bottom line as in the mid-1980s, when he was trying to hold the $A up. They have lost their role as the chief anti-inflation “hawks” because of the high interest rate pain reflected in their banks’ mounting bad debt provisions. And they shift between alarmist doomsaying and libertarian indifference to Australia’s foreign debt build-up.

Few have much of substance to say about wider economic policy issues: it’s not what they are paid to do. The exceptions include the Chase AMP’s Garry White, whose background in the old Industries Assistance Commission gives him an expertise in trade and industry matters, and the HongKong Bank’s Jeff Schubert, an ex-Prime Minister & Cabinet econocrat who has enthusiastically pushed his idea of a variable rate consumption tax as a way to reactivate fiscal fine tuning.

Similarly, the business economists have relatively little impact in public policy debates, although one of their most prominent members – CRA’s John Macleod – is the current president of the Economic Society. While economists appear to have a surprisingly small influence within Australia’s major industrial companies, the increasing role of business leaders in public policy debates perhaps is reflected by the appointment of a former Australian Industry Development Corporation economist, Carol Austin, to BHP.

However, the Business Council, these days headed by former senior Treasury official Peter McLaughlin and employing ex-Canberra econocrat Mathew Butlin, continues to shoulder much of the burden of trying to educate corporate leaders in economics.

The Business Council has taken the lead in labour market reform, but has left the Confederation of Australian Industry to make the running in the industrial relations theatre of the Industrial Relations Commission.

It has also concentrated on policies to reform transport bottlenecks, but has found it difficult to take the policy lead on issues which conflict with its constituencies’ self-interest, such as telecommunications reform, lower tariffs and tax reform.

Until its recent decline, Michael Porter’s Centre of Policy Studies at Monash University represented the cutting edge of the ruggedly pro-market think tanks which continue to push the spread of rationalist criteria. These include Porter’s new Tasman Institute, John Hyde’s Australian Institute for Public Policy in Perth, Greg Lindsay’s Centre for Independent Studies in Sydney and, getting well into polemics, Melbourne’s Institute of Public Affairs.

So far, there has been no strong counter from the social democrat Left, apart from the revival of the labour movement-oriented Evatt Research Centre in Sydney led by Peter Botsman.

A newer source of economic analysis has come from consultants such as Access Economics, headed by ex-Treasury officials Geoff Carmody, David Chessell and Ed Shann, who have sought to compete with Melbourne’s Syntec on macroeconomic policy and business-cycle advice to the corporate sector. Carmody and Chessell, in particular, are closer to the “Stone-age” Treasury than today’s “can do” Keating econocrats, and have advised the Liberal Party on tax issues.

Also prominent is the Canberra-based Centre for International Economics set up by a former Bureau of Agricultural Economics director, Andrew Stoeckel, and staffed with like-minded ex-IAC officials. Stoeckel has carried out major international studies on the costs of agricultural protectionism and, in another sign of the rationalist times, is now heading the analytical attack on the rural socialism of the reserve price scheme for wool.

For the rationalists, however, some of their early policy wins have produced some sobering realities in practice. The first big win was Paul Keating’s decision to push through a startled Labour Party the financial deregulation recommendations of the Campbell Committee.

But the pro-market economists behind financial liberalisation clearly did not pay enough attention to prudential supervision of a liberalised banking sector, nor to the securities regulation of a corporate sector which was suddenly much freer to borrow. They overestimated the strength of the challenge from foreign bank entry to the established domestic oligopoly – an empirically depressing result for the theory of “contestability” which does not bode well for domestic airline deregulation.

And they were not prepared for the speculative volatility of financial asset markets. The famous US economist, Milton Friedman, thought that speculation would not be destabilising as this would require people to irrationally buy high and sell low. This is exactly what the corporate entrepreneurs did in the mid-to-late 1980s, by both initiating and then being swept along and finally under by the psychology of the herd and the boom-bust of asset prices.

In contrast, the labour market provides an example where the rationalists continue to drive the intellectual debate but where practical men still have their hands on the levers of reform. Rationalist academics such as the sometime utopian founder of Flinders University’s National Institute of Labour Studies, Richard Blandy, and the author of the Greiner Government’s industrial relations reforms, John Niland, have been pushing for a less centralised labour market policy since the 1970s.

But, it has only been since the shock of the mid-1980s balance of payments crisis and the “New Right” challenge of disputes such as Mudginberri and Robe River, that the Government and the ACTU have been forced to try to squeeze supply-side labour market improvements from their centralised wage Accord.

And it is reform on the terms of the power brokers in the labour movement -chiefly ACTU secretary Bill Kelty – who retain the close support of Paul Keating. The mainstream rationalist economists continue to give grudging support for the Accord’s ability to dampen the inflationary bias which stems from Australia’s labour market rigidities.

But they are reserving their judgement on the Western European style “award restructuring” reforms designed to increase the job market’s “functional flexibility”. To survive, the Kelty plan eventually will have to deliver the economic goods.

Finally, the fascinating and controversial new challenge to the orthodoxy of economic policy-making has come not from the Left but from two rationalist ANU economists.

Professor John Pitchford has argued that the balance-of-payments blow-out of the 1980s is not necessarily a “problem” and, in particular, nothing that justifies driving the economy into recession with high interest rates to try to cut off import growth. A current account deficit is just as likely to represent foreign capital inflow in search of investment opportunities in Australia as any decline in the economy’s trade performance.

And Peter Forsyth has argued that micro-economic reform may increase economic efficiency and national income, but also will not solve any balance-of-payments “problem” because it will not change the gap between national investment and saving which, by definition, equals the current account deficit.

Yet, while these two closely allied ideas have swept through the universities to gain acceptance from probably the majority of university econo mists, they have yet to influence the political debate substantially.

Nor is it clear how they will, given that both Pitchford and Forsyth support the pro-market thrust of the rationalist economic reform agenda, but not for the reasons claimed by the econocrats and politicians.”

Jonno, Adelaide Hills 🦘🌏

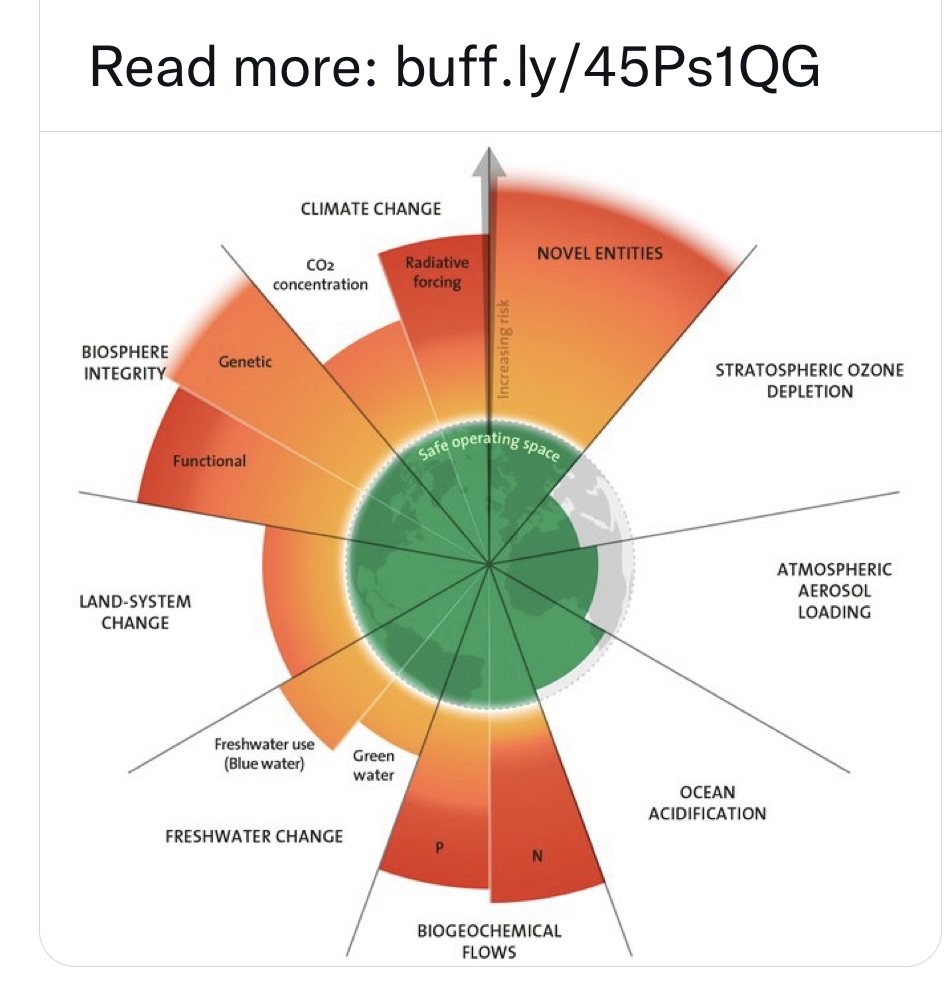

• Restoration of NON military-industrial-scientistic Complex Objet-sujet¹ scientific enquiry not least in honour of DD Eisenhower 1951

• Neurocognitive Health

• IMMEDIATE ADOPTION of 2-5 set series quantum relations self-consciously deliberatively macro metally conceived ordered sequentia logic by some 250 governments de jurê & de facto around the collapsing world

• The conscientised, fully explicated.. pre pubescent kids “go” Yeh 🙂 .. planned, implemented “9 ⭕️” micro through meso through macro economy after Community Economist independent journalist’s newsletter Australia 1995

• Futures at least hypothetic

Sunday 23062025 Mt Barker South Australia

¹Object-subject